Net Present Value Plus

Net Present Value Plus, or NPV+, is an approach to benefit-cost analysis for capital projects. Virtually any entity making a capital investment—cities, states, universities—can use NPV+ to better plan for a more realistic future.

Traditionally, benefit-cost analysis uses the net present value (NPV) formula, which adds up revenue and expenditures over a period of time and discounts those cash flows by the cost of money (determined by the interest rate). The NPV calculation effectively states the lifetime value of an investment in present terms.

Traditionally, benefit-cost analysis uses the net present value (NPV) formula, which adds up revenue and expenditures over a period of time and discounts those cash flows by the cost of money (determined by the interest rate). The NPV calculation effectively states the lifetime value of an investment in present terms.

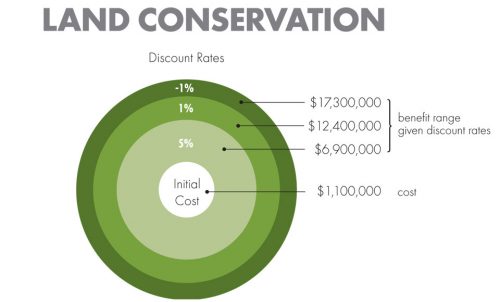

NPV+ expands on the familiar NPV analysis by embedding the analysis into a more explicit scenario about how the context will shift as we are entering a predictable future of more climate change and resource constraints. This means potentially including currently unpriced factors that may become material, such as the cost of environmental degradation, and benefits like ecological resiliency. In the NPV+ framework, any investment may be a “capital project;” all costs and benefits—even those where no monetary exchange occurs—are “cash flows;” and those cash flows can be evaluated using the NPV+ framework. Whether the capital project involves buying vehicles, resource-efficient buildings, land conservation or mass transit systems, NPV+ can provide more comprehensive guidance on the long-term value of the investment.

It is often assumed that economic growth will continue at historical rates for decades to come; that fuel prices will remain affordable and grow at a moderate rate; and that some benefits and costs will continue to be externalized. To create a more realistic context for capital decisions, NPV+ does not assume a static future, but starts with picking a scenario informed by the shifting importance of climate change and resource constraints and its potential impact on economic futures. Along with recognizing normally unaccounted-for factors, this approach offers a way to bracket potential future values of investments and obtain more comprehensive life-cycle accounting (hence the “plus”).

NPV+ can help policymakers and budget analysts to focus on maximizing long-term wealth and provide realistic guidance in a time of growing constraints, including higher resource costs, changing climate, and historically atypical economic performance.

Sample NPV+ Analyses

NPV+ was developed with the support of then Maryland Governor Martin O’Malley, the cooperation of Maryland agency staff, and the financial support of the Rockefeller Foundation. In this initial project, NPV+ was used to analyze four types of spending decisions routinely made by the state of Maryland: vehicles, weatherization, land conservation, and facilities.

Additional Resources

Summary Report: Making the Economic Case for Sustainable Investments in Maryland

Choosing Success: Contrasting Ecological Footprint Analysis with NPV+

Fast Company: NPV+ is a method of accounting that allows for environmental and social factors, so you know what things actually cost.

Governing Magazine: Former Maryland Gov. Martin O’Malley, a possible presidential contender, wants more states to adopt a new measurement tool called “net present value plus.”